Stargate: A Native Asset Bridge Revolutionizing Cross-Chain Transactions

In the rapidly evolving world of blockchain technology, seamless interoperability between different chains has been a long-standing challenge. Traditional methods of bridging between chains often come with significant drawbacks such as high fees, bridging risks, and slow transaction times. However, in 2022, a groundbreaking solution emerged in the form of Stargate, a native asset bridge built on LayerZero.

Before Stargate, bridging assets between different chains was far from ideal due to downsides like costly fees, bridging risks (exploits), and lengthy transaction times. One of the key strengths of Stargate lies in its utilization of LayerZero, a powerful infrastructure that unifies liquidity across all chains. As a result, assets transferred from Chain A are received on Chain B, mitigating the risks associated with cross-chain transactions. Features such as speed, the ability of participants to stake their assets into single-sides pools and the ability for transacting in native assets (eliminating the need for intermediary tokens such as WETH) give this project a competitive edge and make it an interesting proposition for 22/7 LP.

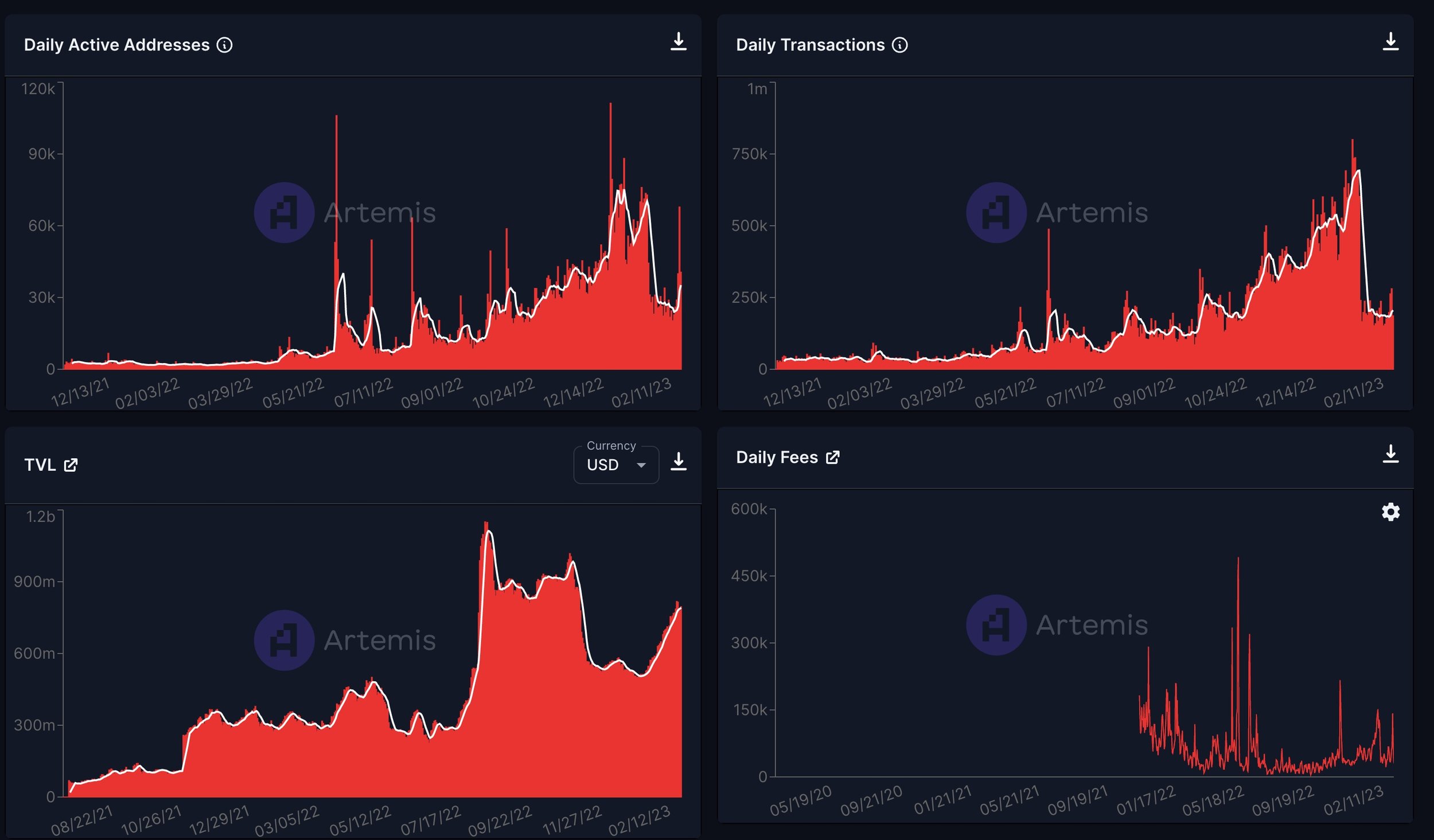

The project is led by Bryan Pellegrino, the CEO, and Co-Founder, along with Ryan Zarick, Co-Founder, and CTO. Their expertise and commitment have driven the platform's innovation and growth which has been remarkable. Revenue has been surging throughout 2023, reaching an ARR of $20.83 million. Additionally, active daily users have surpassed 52,600 users. The platform's daily transactions have skyrocketed from under 4,000 in March to over 200,000 currently, accompanied by a surge in daily volume from $4 million to $100 million.

Having garnered support from reputable investors, including Sequoia Capital and a16z, the platform's native tokens, $STG and $veSTG, play a crucial role in its ecosystem. $STG token holders have governance rights over the protocol and can participate in providing liquidity.

In summary, Stargate has revolutionized cross-chain transactions, providing a solution that addresses the shortcomings of traditional bridging methods. As the platform continues to expand its capabilities and reach, it promises to shape the future of cross-chain liquidity. With its impressive growth, dominant position in the market, and strong team of supporters, Stargate Finance is poised to lead the way in the rapidly evolving blockchain landscape.

Immutable: A Good Fit for the 22/7 Portfolio

Immutable, a layer-2 scaling solution for Ethereum, has rapidly gained recognition for its ability to enable fast, secure, and gas-free NFT trading, built on StarkWare's StarkEx technology. With a strong foundation, scalability, user-friendliness and potential for long term growth, we are bullish and believe that Immutable aligns well with the 22/7 LP portfolio.

A Well-Funded Project with a Strong Team: Immutable has successfully raised over $500 million from reputable investors, including Coinbase Ventures, Paradigm, and Temasek. This substantial funding is a testament to the project's credibility and positions it for future success. Led by experienced entrepreneurs with a proven track record in the blockchain space, the team brings expertise, innovation, and a shared vision to driving them forward.

Large and Growing User Base: With over $1 billion in NFT transactions already processed, Immutable boasts a rapidly expanding user base. Major NFT projects like Gods Unchained, Sorare, and Decentraland have already embraced the platform, further solidifying its position in the market. As more NFT projects adopt Immutable, the platform's user base is expected to continue growing, creating ample opportunities for investors.

Scalability to Meet Growing NFT Demand: Scalability is a critical factor in the success of any blockchain solution. Immutable stands out by offering impressive scalability capabilities. With the ability to process up to 9,000 transactions per second, it outperforms Ethereum's mainnet in terms of speed and efficiency. This scalability ensures that the platform can effectively handle the growing demand for NFTs, providing a seamless experience for users.

Cost-Efficient Transactions: Investment transactions often come with a host of intermediaries and associated fees. Immutable offers a cost-efficient alternative by minimizing transaction costs. By eliminating gas fees and reducing the involvement of intermediaries, the platform provides a more cost-effective solution for investors.

User-Friendly Interface: A user-friendly platform is essential for attracting and retaining a diverse range of users. Immutable excels in this aspect with its intuitive and streamlined interface. Buyers and sellers can easily navigate the platform, facilitating smooth transactions and enhancing the overall user experience. This user-friendliness opens up opportunities for widespread adoption and broader market reach.

Immutable is a well-funded, well-run, and scalable solution for NFT trading. Their native token $IMX integrates well into the 22/7 portfolio. With an impressive founding team and track record, and growing user base it offers a compelling investment opportunity. While acknowledging potential risks, the long-term upside of investing in Immutable aligns with 22/7s objectives and our limited partners. By embracing this innovative technology our fund is well positioned for success in the evolving NFT market.

OP, Arbitrum, Starknet , ZK - and the battle for L2 domination

Blockchain technology has revolutionized the way we transfer value and store information. However, the current infrastructure of most blockchains, including the first-generation blockchains such as Bitcoin and Ethereum, suffer from scalability issues and high transaction fees. This has given rise to the development of layer 2 solutions, which aim to address these limitations while still utilizing the security of the underlying blockchain.

Layer 2 solutions are designed to operate on top of existing blockchain networks, offering faster and cheaper transactions while maintaining the security of the underlying blockchain. These solutions use various techniques such as off-chain transactions, sharding, and side chains to increase the transaction speed and lower the cost of transactions.

One of the most promising layer 2 is the Ethereum scaling solutions, which aims to increase the transaction speed and lower the cost of transactions on the Ethereum network. Some of these solutions include the Optimistic Rollup, Zk-Rollup, and Validation as a Service. These solutions use various techniques such as off-chain transactions and sharding to increase the transaction speed and lower the cost of transactions on the Ethereum network.

Investing in layer 2 solutions is a good opportunity for us at 22/7 as this technology has the potential to drive mass adoption of blockchain applications. With faster and cheaper transactions, layer 2 solutions will make it easier for businesses and individuals to use blockchain technology for various use cases, such as remittances, micropayments, and decentralized finance applications.

Taking the example of Optimism - funded by a16z and seeing strong developer adoption, we can see an increase in projects deployed, developers on the platform and transaction volume. All of these signals are leading indicators for us as 22/7, signaling protocol adoption and subsequently potential to unlock investment opportunities in Optimisms native token $OP.

Why We Believe in Polygon

It all begins with an idea.

The world of blockchain technology is constantly evolving, and the emergence of Polygon marks a new era of decentralized innovation. Polygon is a fast-growing blockchain network that aims to solve the scalability and interoperability issues that have long plagued the first-generation blockchains such as Ethereum.

Polygon is built on the Ethereum network and offers a multi-chain architecture that supports Ethereum-compatible decentralized applications and enables fast, cheap and secure transactions. This makes Polygon an ideal platform for decentralized finance (DeFi) applications, gaming, and other high-volume use cases. One of the key features of Polygon is its use of a proof-of-stake consensus mechanism, which allows for faster transaction timesand lower fees compared to traditional proof-of-work blockchains. This makes it an attractive platform for developers and businesses looking to build on blockchain technology.

The native currency of the Polygon network is Matic, which is used for transaction fees, staking and governance. As the adoption of Polygon grows and more decentralized applications are built on the network, the demand for Matic is expected to increase, providing a good return on investment for Matic holders.In addition, Polygon has a strong and growing community of developers, investors, and enthusiasts, who are committed to driving its growth and adoption. This community is working on developing new and innovative use cases for the Polygon network, which is expected to further drive the demand for Matic.

In conclusion, Polygon is a promising blockchain network with a bright future ahead. Its focus on scalability and interoperability, combined with its strong community and growing ecosystem of decentralized applications, makes it a compelling investment opportunity for 22/7. If you're looking for a high-potential investment in the blockchain space, consider investing in MATIC, the native currency of the Polygon network.